What Is a USDA Loan and How Can It Help You Buy a Home With Zero Down

What Is a USDA Loan and How Can It Help You Buy a Home With Zero Down?

Imagine unlocking the door to your very first home, nestled in the quiet charm of the Virginia countryside—without putting a single dollar down.

For many first-time home buyers, military families PCSing to Virginia, or renters dreaming of homeownership, this might sound too good to be true. But it’s not. If you’re buying in a qualified rural or suburban area, the USDA loan could be your golden ticket to affordable homeownership.

In this guide, I’ll walk you through what a USDA loan is, how it works, who qualifies, and how it could solve one of the biggest challenges new buyers face: coming up with a down payment. Whether you’re relocating to Spotsylvania, Orange County, or Locust Grove—or buying land to build your dream home—this loan could be a game-changer.

Understanding the USDA Loan Program: Not Just for Farmers

When most people hear about USDA loans, the first thing that grabs their attention is the zero down payment—and for good reason. But the truth is, USDA loans come packed with additional benefits that make them one of the most affordable and buyer-friendly mortgage options on the market, especially for those looking to purchase in more rural or suburban parts of Virginia.

Let’s break down what’s actually included in a USDA loan and why it might be the smartest move for first-time buyers, military families relocating to the area, or even renters ready to make the leap into homeownership.

First and foremost, the USDA loan program offers 100% financing. That means you can finance the full purchase price of your home without needing to put a single dollar down. In a housing market where saving for a down payment can feel overwhelming—especially when you're juggling rent, moving expenses, or other life costs—this feature alone can be life-changing.

Backed by the U.S. Department of Agriculture, this loan was created to stimulate growth in rural communities—but many of these “rural” areas include charming suburbs and small towns throughout Virginia.

Where Can You Use a USDA Loan in Virginia?

Many people are surprised to find out just how many areas qualify as “rural” under the USDA guidelines.

If you’re looking in or around these communities, you may be eligible:

-

Madison

-

Part of Stafford and Caroline Counties

These locations offer the perfect blend of small-town peace and big-city access—ideal for military families, remote workers, and anyone seeking a slower, more affordable pace of life.

✅ And yes, buying land to build a home is possible too, as long as the property qualifies and the loan guidelines are followed.

USDA Loan Requirements: What You Need to Qualify

You don’t have to have perfect credit or a huge income to get a USDA loan. But there are a few requirements you’ll need to meet.

Basic USDA Loan Qualifications:

-

Location: The property must be in a USDA-eligible rural or suburban area.

-

Income Limits: Your household income must not exceed 115% of the median income for your area.

-

Credit Score: Typically, lenders look for a score of 640 or higher, but lower scores may still qualify with additional documentation.

-

Debt-to-Income Ratio: Your monthly debts should not exceed about 41% of your income (some flexibility applies).

-

Primary Residence: The home must be your primary residence—no investment properties or vacation homes.

What’s Included in a USDA Loan?

USDA loans don’t just offer zero down—they also come with several other buyer-friendly features.

-

No down payment required

-

Competitive fixed interest rates

-

Low monthly mortgage insurance

-

Flexible credit guidelines

-

Option to roll closing costs into the loan

-

Available for both new construction and existing homes

For renters who feel trapped by rising costs, this can be the most affordable pathway to ownership. And for sellers in areas where USDA loans are common, highlighting that your home qualifies can attract a much broader pool of buyers.

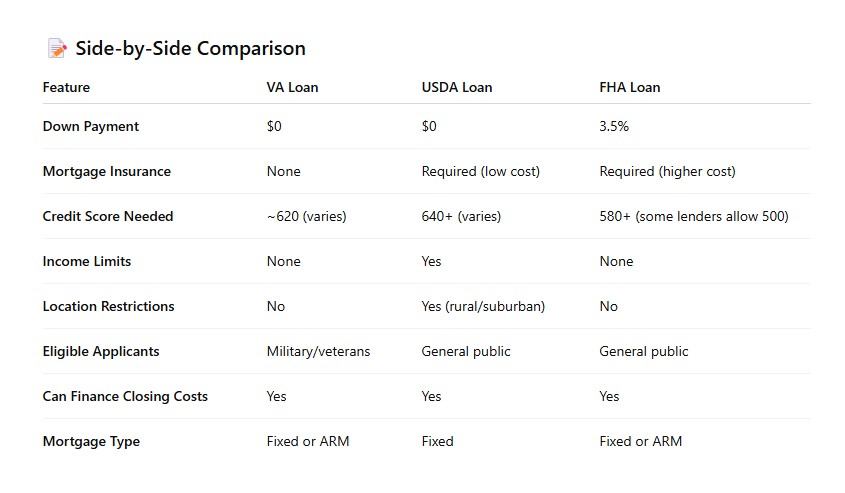

USDA vs VA vs FHA: Which Loan Is Right for You?

Choosing the right mortgage isn’t just about picking the one with the lowest interest rate—it’s about finding a loan that fits your financial situation, eligibility, and future goals. For many most buyers the four most common loan options are USDA, conventional, FHA and VA loans. If you're active-duty military or a veteran, you may qualify for a VA loan, another zero-down option. But not all military families meet VA eligibility, especially newer service members or surviving spouses. FHA loans are ideal for buyers who may not have perfect credit or who are buying in areas that don’t qualify for USDA loans. While it requires a small down payment and includes mortgage insurance, it provides accessibility when other options are out of reach. The USDA loan can be a powerful zero-down tool. And unlike VA loans, you don’t need a military connection—just the right location and income level.

Which Loan Should You Choose?

Choosing the right loan depends on your personal situation, but here are a few quick scenarios:

-

You're military and eligible? → VA loan is likely your best bet—no down payment and no PMI.

-

You’re buying in a rural/suburban area with moderate income? → USDA loan can give you 100% financing with low monthly costs.

-

You’ve got lower credit or a higher debt ratio? → FHA loan may be your most flexible and accessible route.

And remember—not every lender offers all loan types, and not every real estate agent knows how to spot USDA-eligible properties or help navigate the VA process. That’s why working with a local agent who understands the Virginia market and your unique situation can make all the difference.

Ready to Buy With Zero Down? Let’s Talk!

While the zero down payment grabs the spotlight, it’s the full package of benefits—affordable monthly payments, lower upfront costs, competitive interest rates, and flexible loan terms—that truly make the USDA loan stand out. When you team up with a trusted lender and a real estate agent who knows the ins and outs of USDA-eligible areas and guidelines, this loan can become your fast track to homeownership If you’re ready to stop renting, start building equity, and finally call Virginia home, a USDA loan could be the perfect fit for you.

➡️ Let’s schedule a no-pressure consultation to see if you qualify and talk through your options.

❓ Want to know if your area qualifies? Reach out, and I’ll run a custom location check for you.

Call, text, or email me anytime—I’m here to help you unlock homeownership with confidence.

Categories

Recent Posts

Buying a home isn’t just a financial decision—it’s a deeply personal journey filled with hopes, dreams, and big life changes. That’s why choosing the right real estate professional is one of the most important steps you can take.

A knowledgeable and experienced REALTOR® does more than open doors and write offers. They’re your advocate, your problem-solver, and your steady guide through what can sometimes feel like an overwhelming process. Whether it's navigating a competitive market, negotiating on your behalf, or keeping things on track behind the scenes, the right agent is there to protect your interests every step of the way.

In the end, buying a home should be an empowering experience. With the right person by your side—someone who brings both expertise and heart—you can move forward with confidence, knowing you're in good hands with Sean Jones.

GET MORE INFORMATION