The Ultimate Guide to Buying Your First Home in Virginia: What Every First-Time Buyer (Especially Military Families & Renters) Needs to Know

Step-by-Step Guide to Buying Your First Home in Virginia: A Must-Read for New Buyers

If you’ve been dreaming of owning your own home—whether you’re tired of renting, moving to Virginia on military orders, or finally ready to plant roots—welcome to the start of an exciting (and sometimes overwhelming) journey. The truth is, buying your first home is a major milestone, but it can also feel like stepping into the unknown. What’s the first step? How much do you need to save? Who should you trust to guide you? What if you make a mistake?

Take a deep breath—you’re not alone, and I’m here to walk you through it.

In this guide, I’ll break down everything you need to know to confidently take your first steps toward homeownership, from setting goals to crossing the finish line on closing day. Whether you're PCSing to Virginia, saying goodbye to renting, or just exploring your options, you'll walk away with clarity, confidence, and a few powerful resources.

Why First-Time Buyers Struggle (And How You Can Avoid It)

Let’s be real—most first-time buyers hit the same roadblocks. It often starts with uncertainty about where to begin. There are so many moving parts that the process can feel overwhelming. From financing to house hunting to negotiating, it can feel like you’re navigating a foreign language. Add in misinformation from social media, well-meaning friends, or outdated blogs, and it’s no wonder so many people delay buying for years.

I’ve seen buyers lose out on homes or waste months searching because they didn’t have the right plan or support. But the good news? These challenges are completely avoidable. With the right guidance, resources, and strategy tailored to your unique situation, the process becomes clear, structured, and even exciting.

Step 1: Get Clear on Your Goals

Every successful journey starts with a destination. Before you dive into listings or lenders, take a moment to really reflect on what you want this next chapter of your life to look like. Buying a home isn’t just a financial decision—it’s deeply personal. Do you envision weekend barbecues in a backyard? A quiet retreat after a long day of work? A home office with space to grow your business or career?

Understanding what matters most to you will help you make informed decisions when the time comes to choose between multiple homes. Maybe proximity to a military base, like Fort Belvoir or Quantico, is a top priority. Maybe it's living in a walkable neighborhood with parks and schools close by. When you define your goals from the start, you avoid wasting time on homes that don’t align with your values and long-term vision. This clarity empowers your agent to advocate more effectively on your behalf.

Step 2: Review Your Finances (Without Getting Intimidated)

Money is one of the biggest concerns for first-time buyers—and understandably so. But here’s the thing: you don’t need to have perfect credit or a huge bank account to get started. What you do need is a clear understanding of where you stand financially and how that impacts your buying power.

Start by reviewing your income, monthly expenses, debts, and current savings. This isn’t about judgment; it’s about establishing a solid foundation. From there, determine how much you’re comfortable spending each month on a mortgage. Keep in mind that your mortgage payment isn’t just the principal and interest. It also includes taxes, insurance, and in some cases, HOA fees.

✅ If you're military, don’t forget that your Basic Allowance for Housing (BAH) can be used to help cover your mortgage.

For renters, consider how much you're already paying in rent and whether it makes more sense to put that money toward building equity instead of someone else's investment.

Step 3: Get Pre-Approved with the Right Lender

Before you fall in love with a home, it’s essential to know what you can afford—and what kind of loan works best for your situation. Pre-approval is more than just a step in the process; it’s your key to house hunting with confidence.

If you’re active duty or a veteran, VA loans are an incredible benefit you should absolutely take advantage of. They offer zero down payment, no private mortgage insurance, and favorable interest rates. This can make homeownership accessible much sooner than many people think. Other great options include FHA loans, which have lower credit score requirements and low down payments, or VHDA programs, which offer down payment assistance to first-time buyers in Virginia.

The lender you choose should be someone who understands your unique needs and communicates clearly. This isn’t the time to go with a random online lender who won’t return your calls. Having someone who knows the local market and has experience with VA or first-time buyer programs can make a world of difference.

Step 4: Hire the Right Real Estate Agent (This One’s Big)

Let’s be honest: Not all agents are created equal. And when it’s your first home, who you hire absolutely matters. A great agent can save you time, money, and stress. A not-so-great one can cost you your dream home.

When choosing a REALTOR®, look for someone who specializes in working with first-time buyers. You want someone who understands the emotional side of buying your first home as much as they understand the market. They should be patient, communicative, and proactive. You should feel heard and supported, not rushed or confused.

As someone who works closely with military families PCSing to Virginia and renters transitioning into homeownership, I know firsthand how important it is to tailor the process to each individual client. From helping you understand local market trends to crafting strong offers that win, a good agent is truly your greatest asset.

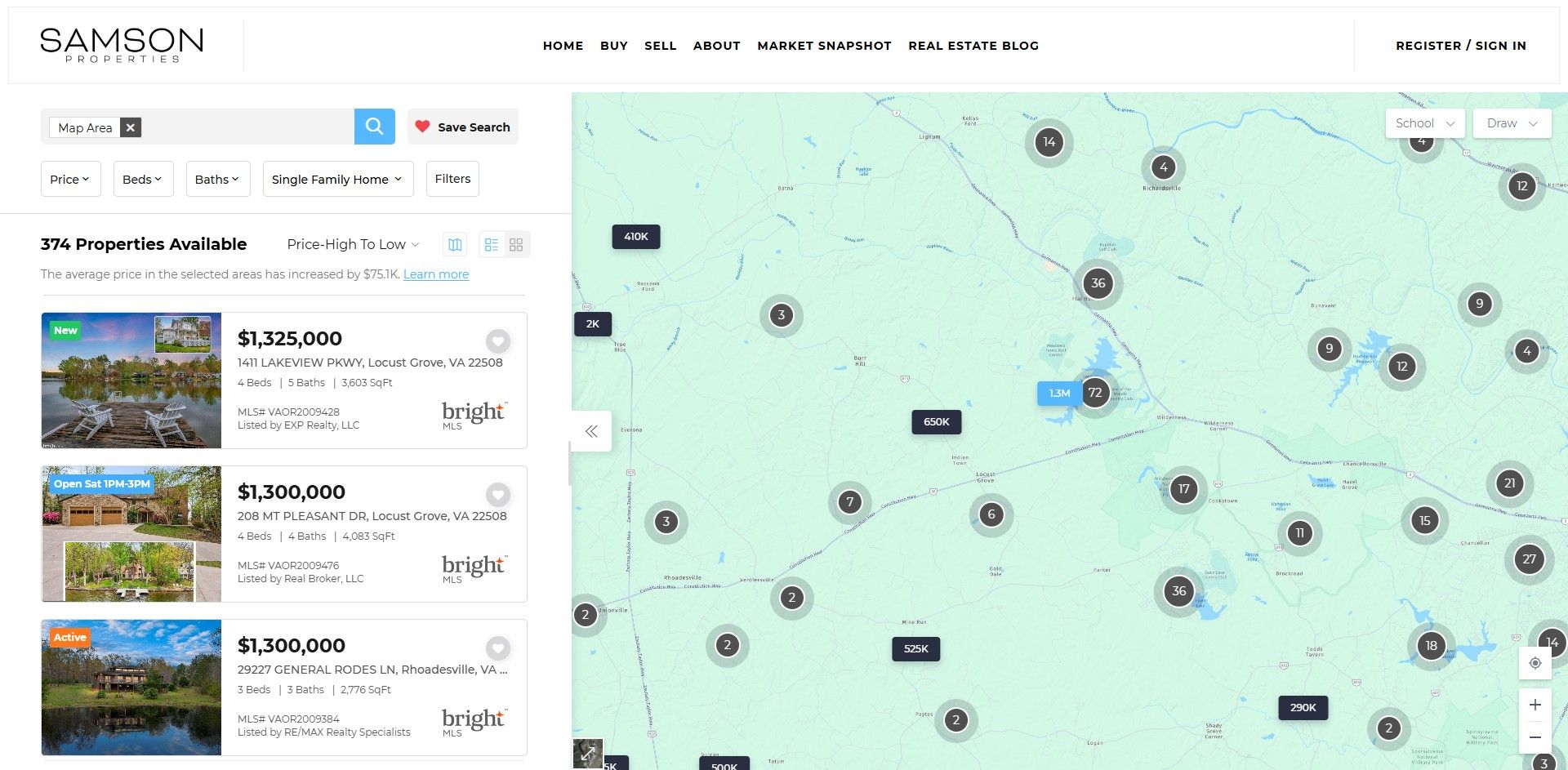

Step 5: Start Your Home Search (Smartly)

This is where it starts to get fun—but it’s also where buyers can get off track quickly. With so many listings, open houses, and endless scrolling through real estate websites, it’s easy to lose focus.

That’s why it’s so important to go back to your goals and stay rooted in them. When you walk into a home, ask yourself, "Does this move me closer to the life I want to live?" Work with your agent to prioritize showings based on your criteria and avoid distraction from properties that don’t align with your needs.

Remember, your dream home might not check every single box, but it should feel right. Sometimes buyers discover new must-haves or deal-breakers after touring a few homes, and that’s okay. The goal is to refine and learn as you go so when the right home comes along, you’re ready to act.

Step 6: Make an Offer & Negotiate Like a Pro

Found the one? Let’s make it yours. Writing an offer is both an art and a science. It requires understanding the current market, the seller’s motivations, and how to position your offer competitively without overpaying.

Your agent will guide you through the paperwork, help you decide on a price, and include terms and contingencies that protect your interests. This might include things like a home inspection, radon inspection, pest inspection, financing contingency, or requests for seller-paid closing costs.

In competitive markets, the strength of your offer can make or break your chances. That’s where having a great agent pays off. They’ll help you understand how to make your offer stand out while also ensuring you don’t waive important protections. A strong offer isn’t always about the highest price—sometimes it's about the cleanest terms and the most confidence-inspiring presentation.

Step 7: Inspections, Appraisals, and Paperwork—Oh My!

This part might not be glamorous, but it’s essential to protect your investment. Once your offer is accepted, the due diligence phase begins. A home inspection will give you insight into the condition of the home and uncover any potential issues that may need to be addressed.

Depending on the property, you may also need specialized inspections—such as radon inspetion, well and septic inspection, or a wood-destroying insect inspection (required for VA loans). These inspections are your opportunity to make sure the home is structurally sound and that you’re not walking into costly repairs.

Your lender will also order an appraisal to verify that the home’s value matches the purchase price. This protects both you and the bank from overpaying. Meanwhile, the title company will ensure there are no legal issues with transferring ownership. It might feel like a lot, but your agent and lender will guide you through each step.

Step 8: Closing Day – You Did It!

Closing typically happens 30 to 45 days after your offer is accepted depending on the loan type. As the big day approaches, you’ll do a final walkthrough of the home to ensure everything is as agreed—repairs completed, no new damage, and the property in good condition.

Then comes the closing itself. You’ll meet with the title agent (often an attorney), your agent, and possibly your lender. You’ll review and sign the final loan documents and pay any remaining closing costs or down payment. Don’t worry—your title agent will walk you through every document and explain what it means.

The moment you finish signing, the home is officially yours. The feeling of holding those keys in your hand for the first time is indescribable. You did it. You took the leap, stayed the course, and now you have a place to call your own.

Ready to Start Your Homeownership Journey?

Buying your first home doesn’t have to feel overwhelming—not when you have the right guidance, tools, and support. Whether you're PCSing to Fort Belvoir or Quantico, tired of renting, or just exploring your options, I’m here to help you every step of the way.

Let’s create a plan tailored to your goals. I offer free, no-pressure consultations to help you understand your options, connect with trusted lenders, and map out your journey to homeownership.

Categories

Recent Posts

Buying a home isn’t just a financial decision—it’s a deeply personal journey filled with hopes, dreams, and big life changes. That’s why choosing the right real estate professional is one of the most important steps you can take.

A knowledgeable and experienced REALTOR® does more than open doors and write offers. They’re your advocate, your problem-solver, and your steady guide through what can sometimes feel like an overwhelming process. Whether it's navigating a competitive market, negotiating on your behalf, or keeping things on track behind the scenes, the right agent is there to protect your interests every step of the way.

In the end, buying a home should be an empowering experience. With the right person by your side—someone who brings both expertise and heart—you can move forward with confidence, knowing you're in good hands with Sean Jones.

GET MORE INFORMATION